In today’s world, individuals of different opinions can consider savings and future financial planning as both important and irrelevant, without any of them needing to be wrong. What makes the latter opinion valid? It’s likely to be the robustness of today’s lending market, which is only improving over time.

wrong. What makes the latter opinion valid? It’s likely to be the robustness of today’s lending market, which is only improving over time.

One of the most popular forms of borrowing to address urgent needs is a cash advance. A cash advance, which can come in the form of a credit card cash advance or a non-bank direct lender short-term personal loan, is a short-term loan borrowed for a short amount of money. Many people consider a cash advance to be interchangeable with a payday loan.

Credit Card Cash Advances and Bank Accounts

Credit Card Cash Advances are small amounts of loans available to credit card holders who have an available limit yet to spare. A cash advance of this sort is a percentage of the available credit limit. People without a credit card or an ample limit still left on their credit card would not have access to such a loan.

If such a loan is available to you, all you need to apply for is your credit card, or in most cases, the internet-based banking system linked to your credit card. These loans are instant and feature a fee and compound interest as dictated in your credit card terms.

A bank account is not needed for the transaction of a credit card cash advance; you receive money from an ATM as physical cash. Most credit cards require you to have an active bank checking or savings account to apply for the card in the first place. If you have a credit card, you already have a bank account. If you plan to apply for a credit card, you will likely need a bank account.

Getting Cash Advances without having Credit Cards

Direct Lender Cash Advances from non-bank direct lenders are the cash advances you can avail of without having a credit card. But, you must need a bank or a checking account for such a transaction, in most cases. If a lender offers a cash advance without a bank account or checking account, it may be a fraudulent offer. It is advisable to conduct more research on the lender before agreeing to the transaction.

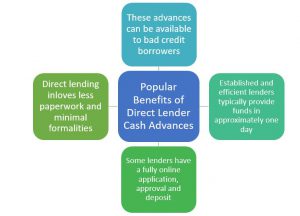

While direct lender cash advances are considered to be at the expensive end of the spectrum of loan product interest rates, the figure below shows what people find to be the main advantages that make such loans appealing and useful.

Checking vs. Savings Accounts for Direct Lender Cash Advances

In earlier days, banking was not dependent on electronic and computerized systems. A checking account was designed for faster transactions but did not pay interest on deposits. Now, there is a limited practical difference between these two types of accounts when it comes to loan transactions. Whether you provide your lender with the details of a checking account or a savings account, the difference it can make is almost negligible.

Conclusion

It is important to have an active savings or checking account when you need to borrow money using any sort of reliable credit product. Credit products that do not need a bank account are likely to be less reliable or even illegitimate. Borrowers should see this as a red flag. Today, the process and requirements for opening a bank account are simple.

When it comes to direct lender cash advances, dealing with a trustworthy and legitimate lender is key. It ensures a fair deal and a safe transaction. CashAmericaToday is one of the most reputable services in its class. It can meet all your direct lender loan needs with competitive deals.