What Are Debt Consolidation Loans?

Debt consolidation loans allow borrowers to consolidate several debts into one loan. The interest rate and the repayment term are set. A debt consolidation loan simplifies the repayment of debts by consolidating several high-interest loans, such as credit cards, medical bills, and personal loans, into one loan with a reduced interest rate.

This allows borrowers to pay off debts more quickly. You can get debt consolidation loans from many lenders, including banks, credit card companies, and online lenders.

Note that consolidation loans do not solve debt problems by themselves. Before borrowers can achieve full financial stability, they must address the issues that led them to accumulate debt, like overspending.

Is a Debt Consolidation Loan a Good Choice?

As of the third quarter of 2024, Americans owed a collective of $1.14 trillion in credit card debt. Increasing debt is what makes people get tense and look to consolidate. Some may do it through their savings, and others would look for a debt consolidation loan. However, is it appropriate to take another loan to consolidate your existing debts? Let's see,

Take a debt consolidation loan if you are getting it at a lower rate of interest than the existing ones and have a stable income to pay off the loan.

CashAmericaToday offers a Debt consolidation loan if you want to consolidate multiple unsecured loans into a single payment or if the interest rate on your current loan is too high.

A Debt Consolidation Loan has the following Benefits:

For those who are struggling with debt, consolidation loans offer many benefits. These are some of the benefits of debt consolidation:

- Simpler Payments: A debt consolidation loan lets you make one monthly payment instead of multiple payments to various creditors. It can simplify your finances, making it easier to manage debt.

- Lower Interest Rates: Debt consolidation loans usually have lower interest rates than other debt types, like credit cards and personal loans. Consolidating your debts can help you save money and pay your debt faster.

- Reduced monthly payments: If you struggle to manage your finances, consolidating your debts into one loan at a lower interest rate can reduce your monthly payments.

- Prove your credit score: You can improve your credit rating by consistently consolidating debts and paying on time.

- Debt payoff: You can pay off your debts with debt consolidation. It can help you to stay motivated and focused toward your goal of debt freedom.

A debt consolidation loan is a good tool to manage debt and improve your financial situation. It's important to consider the terms and conditions carefully and ensure they align with your financial goals.

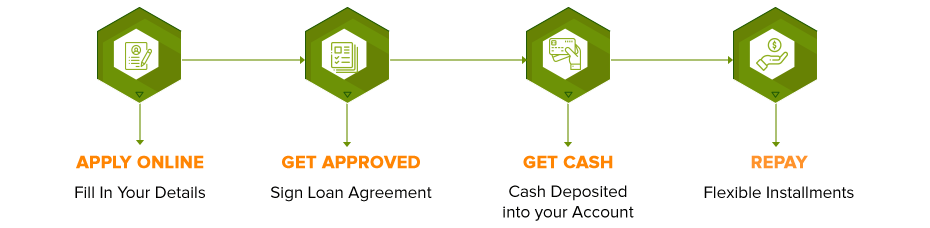

Get a Debt Consolidation Loan Online:

The advantages of applying online weigh heavily than going to a store to get a loan. That's because:

- You save travel time

- You can apply at any time from the comfort of your home

- It's not dependent on "opening hours."

- You can avoid going through paperwork and faxing, which are time-consuming.

Is it possible to get a Debt Consolidation Loan with Bad Credit?

Yes, you may still be able to get a loan for debt consolidation with bad credit. However, it can be difficult. If you are going through traditional lenders, you may not be able to get a debt consolidation loan for bad credit.

Go through direct lenders to have a seamless loan process, even if you have a bad credit score. Direct lenders like us are able to give loans even to people with a bad credit score, as we do not conduct a hard credit check.

We do not differentiate borrowers based on their credit history. We rely on a monthly income of borrowers to process a loan. Another benefit of going through debt consolidation loans for bad credit is that you can get fast funding as there is no time taking process of credit check.

Get a No Credit Check Debt Consolidation Loan from Direct Lender

Direct lenders like us at CashAmericaToday can offer debt consolidation loans to individuals with poor credit scores who have stable income. Direct lenders can offer lower rates of interest and fees than third-party brokers because we don't have to pay intermediaries' commissions or fees.

Apply with CashAmericaToday to get a loan with no hard credit checks. All you have to do is apply through the online form that is available on our website. Upon completion of the process, your checking account will be credited with the funds instantly.

You are Eligible if:

To get a debt consolidation loan with CashAmericaToday, all you need is the following:

- Age must be over 18 years

- Social Security Number (SSN)

- Checking account details

- Verifiable contact details.

- Income statement/ Pay stub

Your loan is determined by your monthly income.